Financial institutions are going through a monumental shift, be it global market or Indian markets. With customers becoming digital-literate, they are demanding options, services, and prices as per their choices. They are expecting a Zomato in banking. Branch banking or paper-based fund transfers are old habits. At least not for the millennials. While the larger retail industry is going through a paradigm shift in terms of channels, services, pricing, customer support, and feedback process; retail banking is still in a catch-up phase. Why?

Banks are old but very large organizations. They have a very large spread of their operations by its customer base, geographies, product types, type of banking, and so on. Also, the regulations are becoming hyper, transactional, and nail-biting. At the same time, banks have become rigid and monolithic in their technological infrastructure. The more these become bigger, the less they become agile. Fintech startups have started giving disruptive services a run for their money and that has put the banking industry at the cusp of a makeover as how to retail and grow my customer base. The learnings are from the larger retail industry has become hyper-personalized to your customers. The question is how?

The Data and Technology Ecosystem

Banks sit on a goldmine of data which is truly an asset for these institutions to harvest the seeds of innovation. The data tells how a customer behaves or wants to behave in financial and economic environment. The gap is to fill it with a product and service. Therefore, the first step is to build a very robust and modern data warehouse, analytics model, and architecture in the company. The AI & ML products are already revolutionizing the data analytics space. If Data sciences, analytics is effectively built using AI & ML engines, the feeds can lead to material insights which are fundamental for developing innovative products, services, and pricing strategies.

Today, machine learning and data analytics can be harnessed to deliver an omni-channel digital experience to your customers. For banks and finance companies with a wealth of data available, hyper personalization represents a window of opportunity to stay ahead of the curve with a value proposition that makes customers feel understood. It also promises significant gains, with Boston Consulting Group estimating that successful personalization at scale could represent an increase of 10% in a banks annual revenue.

One such start up based out of Singapore; a startup that delivers big data solutions centered on choice to help companies better engage with their customers across all channels. The startups personalization engine enables businesses to offer users personalized lifestyle choices, which translates into customer activation, higher response rate, loyalty improvements and increases in both frequency of card usage and spending.

Then there is the Canadian startup which builds personalization solutions with contextual intelligence. Through a triage of data, content, and context, it enables finance providers to better understand their customers and segment them. Moreover, these insights are funneled into digital experiences with highly-engaging content and recommendations for each of them.

The Big Challenge

The challenge and the big gap here is the channels and its capabilities to use data coming from internal systems as well outside ecosystems. This needs massive transformation in banking architectures that focusses on channel integration using open architecture. This demands bank to build APIs and microservices infrastructure and services that can be enhanced or upgraded real-time. If financial institutions focus on building a future-proof architecture for scaling up channels, cross selling products and pushing customer-centric advisory, features and offerings, they can surely improve their customer retention and loyalty scores.

The channels built on robo-advisary platforms can generate personal touch and speed with customer and can fetch more and more data for banks to keep churning and improving its machine learning algorithms. While all this gives banks a necessary make over to stay competitive and innovative, this adds their risk exposure at the same rate.

Digitizing the Regulatory Measures Through Technology

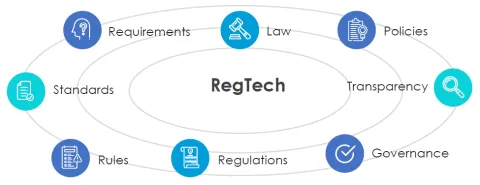

The compliance environment for this industry has always been very demanding and it is becoming almost hostile where the penalties and regulations stop their innovation beyond a risk threshold. The industry, too, in the recent past has experienced a surge in regulations and reporting requirements, which has resulted in the entrance of various technologies and solutions in the market. Regtech (Regulatory Technology) is one such measure that combines people, data, and regulations with an intent to enable firms to achieve a culture of compliance. It is the new savior for the banks to continue their disruptive journey where platforms are available to keep their reporting and compliance accurate, transparent, and trans-national.

A Strategic Tech Partner

All of this can be systematically accelerated if a strategic tech partner joins hands with a bank. The focus can be a multidimensional tech transformation which underpins AI / ML driven data analytics, open architecture platform for integration to channels & outside world via secured APIs and robotics driven customer services. At Cybage, our expertise helps fintech experts, financial institutions, wealth management, banking and insurance companies transform their offerings with custom financial services software and fintech software for emerging customers needs, speed up time to market, compete by means of technology, find valuable business insights, and enrich security of end-products.